Investment Management

After forming a clear understanding of your goals and objectives, at Altermann Fuller Ltd, we create custom portfolios to suit individual purposes. By diversifying holdings and adjusting asset allocations, we can find the right balance between maximizing returns and minimizing risk.

We seek long term investment opportunities while still taking advantage of shorter-term profits when the situation arises. By closely monitoring the investments we hold, the economic landscape, and geopolitical developments, we proactively rebalance and refine portfolios when warranted without needlessly churning.

In addition to maximizing annual profits, we increase the probability of delivering consistent returns year after year.

Customized

At Altermann Fuller Ltd, we build globally diversified portfolios that align with your overall financial goals and stand the test of time. All portfolios are constructed to maximize potential at a risk level that is acceptable to you. Additionally, portfolios accommodate legacy holdings with a view to reducing concentrated positions over time.

Process

We pinpoint high-quality investments and strategies to address a wide range of financial needs. Whether you are planning a comfortable retirement, seeking more income, building wealth for the future, diluting overlarge holdings, or funding a world-class education, we can guide you in the right direction.

We prefer to take a research-heavy, evidence-based approach. Many times we have seen greed or fear drive investor sentiment instead of sound judgment. We concentrate on what has been proved to reward investors over time, such as risk management, diversification, yield, and strategic rebalancing. We can also integrate socially responsible investing in our selection process if you so wish.

Socially Responsible Investing (SRI)

Socially Responsible Investing aligns your values and belief system with the investments that are bought on your behalf. Attention to SRI concerns have been steadily growing in the investment world for many years, and this approach benefits the broader society while still generating solid financial returns.

Recently, Socially Responsible Investing has grown to incorporate Environmental, Social, and Governance (ESG) features. Our clients have access to advanced ESG research and a vast international database that includes thousands of companies.

At Altermann Fuller Ltd, we use established ESG benchmarks to search for and select companies and investments that are best in class. Through our thorough research process, we explore the investment world, identifying companies that score highly for ESG.

Alternative Investments

At Altermann Fuller Ltd, we've been researching and advising on alternative investments for more than a decade. We help you identify suitable opportunities based on your risk/reward constraints and leverage our considerable experience to assist you in building a portfolio that addresses your long-term financial requirements.

Historically, strategies that included alternative investments were reserved for institutional investors, but by using our strategic network of partnerships, we can offer them to our clients when appropriate.

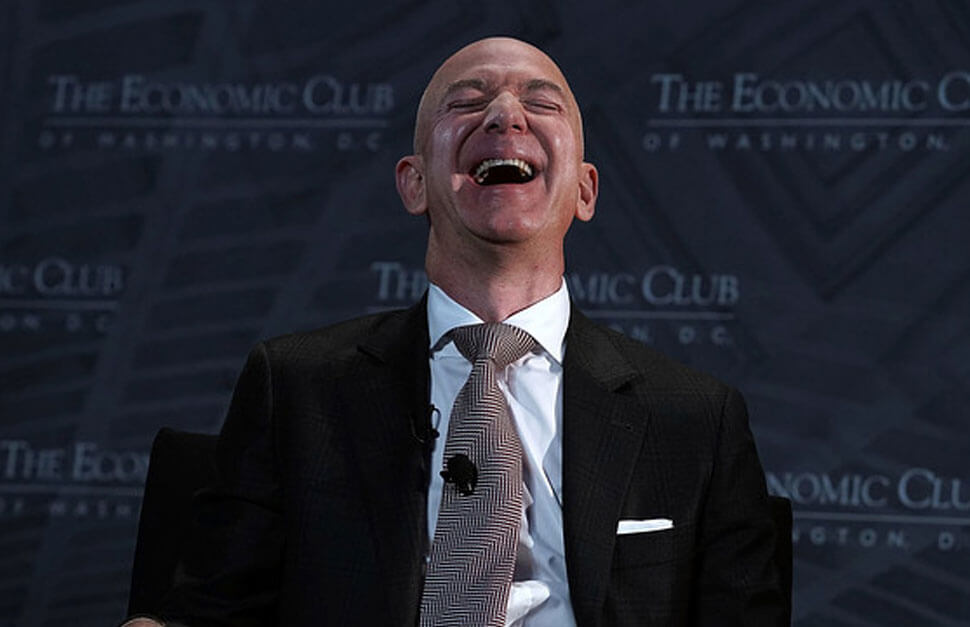

Overlarge Holdings

Having an overlarge exposure to a single company brings additional concerns. Overdependence on one holding can lead to increased volatility and potentially incur significant losses should the company perform poorly.